Det fremgår af en pressemeddelelse fra Global Economic Governance Initiative ved Boston University.

The paper, titled Fueling Growth and Financing Risk: The benefits and risks of China's development finance in the global energy sector, shows that China's development banks lent as much to foreign governments for energy projects as all the major Western-backed MDBs (Multinational Development Banks) combined between 2007 and 2014-upwards of $117.5 billion dollars in energy finance for foreign governments.

Increase in capital

Unlike the Western countries that have been reluctant to increase the capital base of the Multilateral Development Banks, China should be commended for increasing the paid in capital for its two global development banks and for capitalizing two new multilateral development banks in the New Development Bank (NDB) and the Asian Infrastructure Investment Bank (AIIB).

The NDB has dubbed itself a 'sustainable infrastructure bank' and its first tranche of financing has gone to clean energy projects.

China's existing global energy portfolio is heavily exposed to country, macroeconomic, climate, and social risks however.

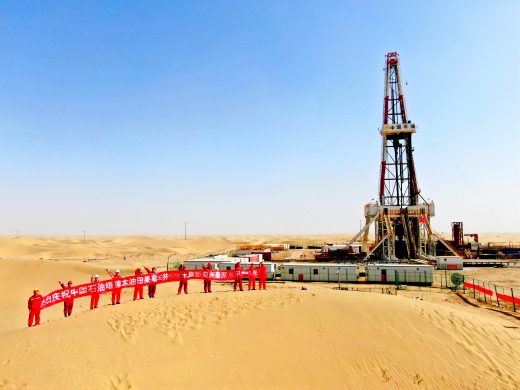

Coal and hydropower

The majority of China's overseas finance is in countries with weaker credit histories and that are now facing significant growth and debt challenges.

Chinese energy finance is also heavily concentrated in coal-fired power plants and large hydropower projects which are increasingly seen as risky assets given that significant social and environmental costs run the risk of major delays and shut downs.

As these efforts move forward it will be essential for China's global policy banks to mitigate the broader risks identified in this paper and meet the broader sustainable development challenge for the 21 st Century and shift the composition of its global energy lending in a significant manner.