Africas projected yearly economic growth could be cut by up to 1,5 percentage points in 2004 and 2005 if international oil prices remain steep for a long period, a senior World Bank official said on Wednesday.

The World Bank has forecast annual growth in Sub-Saharan Africa will quicken to about 5,5 percent in 2004 and 2005, compared with an estimated rate from the African Development Bank of about 3,7 percent last year.

But John Page, the World Banks chief economist for Africa, said in Cape Town that sustained high crude prices through to the middle of next year would be a significant shock for oil importing countries on the worlds poorest continent.

– Including everything on average it is likely to result in perhaps as much as a 1 to 1,5 percent overall decline from the trend rate of growth of GDP, he said on the sidelines of a trade conference. International oil prices have risen above 50 US dollar a barrel as global demand surges, amid disruptions to supply from the Middle East, Africa and even the hurricane-hit Gulf of Mexico.

Page said the impact on individual countries was difficult to predict as some governments had long term oil contracts in place and others may choose to cushion the blow for consumers through subsidies. But oil exporters on the continent could expect a major windfall, with government revenues rising by as much as 56 percent for Equatorial Guinea, he said.

Revenue increases would average about 21 percent for the regions oil producers, which include Nigeria, Angola and Gabon. – For the oil exporting countries obviously it is a tremendous windfall, for the oil importing countries it is going to be a shock the size of which I do not think we really have a complete picture yet,” he said.

Business Day of South Africa notes the World Banks chief economist said Wednesday that high oil prices have had a substantial effect on the foreign exchange reserves of poor countries as well as consumer prices. Already precious foreign exchange reserves were being depleted by as much as a third, and families were paying more for goods in poor countries, said Francois Bourguignon.

– We have an effect of between two and five percent of gross domestic product depending on the oil dependency and dependency on other sources of energy, said Bourguignon, who has been talking to Ethiopian officials about fighting poverty. He said some countries had seen their foreign exchange reserves depleted as much as 30 percent as they struggle to pay for oil.

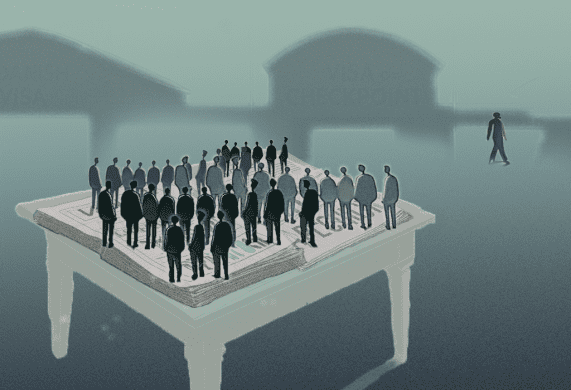

The Financial Times meanwhile reports that Nigerias decision to raise government spending by a quarter next year is an eye-catching example of the impact of high oil prices on a country whose decline has exemplified the failure of international plans to cut poverty in Africa.

Olusegun Obasanjo, president of a nation brought close to economic collapse by corruption, mismanagement and controversial lending from rich countries, said half an oil price windfall estimated at 3,2 billion US dollar (19,2 mia. DKR) so far this year would be spent on improved infrastructure, investment in the oil sector and social services.

The policy, announced in this weeks draft budget, is part of an economic program that is supported by many domestic economists and western governments but opposed by corrupt vested interests and some unions, who have organized protests such as the current general strike over rising fuel prices.

The government, which has saved money this year through budgeting on an oil price of 25 dollar a barrel – compared with over 50 dollar in New York Wednesday – plans to continue its conservative approach by raising the forecast to 27 dollar next year.

The international enthusiasm over Nigerias reforms contrasts with mass domestic protests such as a series of strikes over fuel market deregulation, which have highlighted widespread distrust of government after decades of corrupt and often brutal military and civilian rule.

Kilde: www.worldbank.org