Africa is Open for Business, but Not for Just Any Business

BRUSSELS, 25th November, 2010: Investors focussing too narrowly on the bottom line (regnskabets bundlinje) will find their access to African markets increasingly restricted, the World Bank has warned.

– Africa is open for business, but not just any business, World Bank Vice President for the Africa Region Obiageli Ezekwesili told a summit on “Responsible Investments in Africa”, held November 17 in Brussels, Belgium.

Foreign direct investments (FDI) to the continent rose nearly nine-fold, from 10 billion US dollar in 2000 to 88 billion in 2008. The amount dwarfs flows to India (42 billion) and falls just short of flows to China (108 billion).

The flows are further proof that Africa is “a vital strategic interest” and “the next growth pole in a multi-polar world”, Ezekwesili said.

With the wave of investments strengthening, the challenge, Ms. Ezekwesili told the summit in the Belgian capital, is to ensure that businesses going into Africa are “committed to the ethos of responsible investments”.

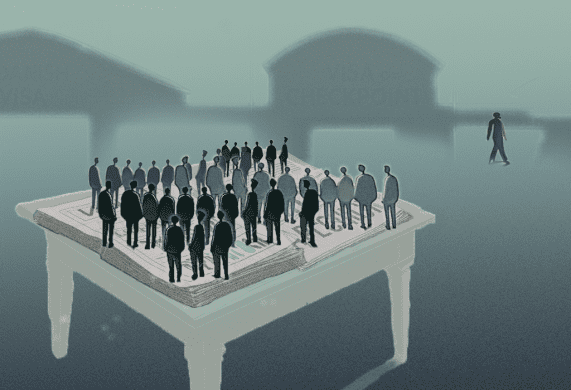

She called for “collaborative partnerships” built on “shared values” that include government, the private sector and development partners and work to ensure that “Africa is not just a destination for investment and development assistance”, but the continent where partners “work together to guarantee returns for investors while promoting social good and poverty reduction”.

ØNSKER NYT NETVÆRK FOR ANSVARLIG INVESTERING I AFRIKA

Responsible investments, she explained, must be “results-based” and should not leave Africa with “a legacy of debt, poverty, disease and a ruined environment”.

Businesses which do not meet these standards can no longer avoid the scrutiny of increasingly demanding citizens’ groups.

– In an Internet, Facebook, and Twitter world, the business of every investor is everyone’s business, Ms. Ezekwesili said, calling for the establishment of an “Africa Responsible Business Network”.

The network would ensure that investments are free of corruption; uphold the highest standards of good governance; promote transparency; generate jobs; show respect for the environment, as well as for social and cultural standards.

Responsible investments, she explained, “spread prosperity, transfer knowledge, create jobs, improve incomes, pull people out of poverty, create new or expand existing markets, while contributing to the stability of our planet”.

The World Bank’s role in Africa goes beyond promoting investments and includes working to “improve governance and combat corruption,” Ms. Ezekwesili said.

The Institutional Integrity Unit combats corruption in World Bank-funded projects. The Bank has also partnered with the United Nations on the Stolen Asset Recovery Initiative (StAR) to “return stolen funds to their rightful owners”.

Ezekwesili called on African countries to deepen implementation of transparency initiatives like the Extractive Industries Transparency Initiative (EITI) and existing conventions and treaties such as the UN Convention against Corruption and the OECD anti-bribery convention.

While the focus on responsible investments is usually on foreign investors, Ms. Ezekwesili said “the onus is also on domestic investors”. She applauded the progress that a number of countries in Africa have made in good governance and the fight against corruption.

The “changing tone of discussions about Africa” at world events and summits, away from “conflict, famine and disease” and towards a continent of the future and of promise, is owed in part to such progress.

Kilde: www.worldbank.org