To help the people of West Africa compete in the global economy, the World Bank recently approved a 408,69 million US dollar financial package to assist the West Africa Economic and Monetary Union (WAEMU).

The money will be used by the eight member countries to build and connect infrastructure and finances and to develop the capital market, according to the Banks website, www.worldbank.org

The money will help the WAEMU Governments intensify their ongoing efforts to consolidate economic and financial activities to better compete in global markets.

The governments want to create a more functional common market, with common tariff and commercial policies, supporting the free circulation of people, goods, services, and capital. In addition to major financial and economic reforms, WAEMU countries have developed a regional transport strategy laying the foundation for an inter-connecting road system to link the eight countries.

The WAEMU Capital Market Development Project will contribute to the economic growth of the WAEMU countries of Benin, Burkina Faso, Cote dIvoire, Mali, Niger, Guinea Bissau, Senegal and Togo, home to a total of 72 million people, and their efforts to improve the availability and affordability of modern infrastructure and financial services.

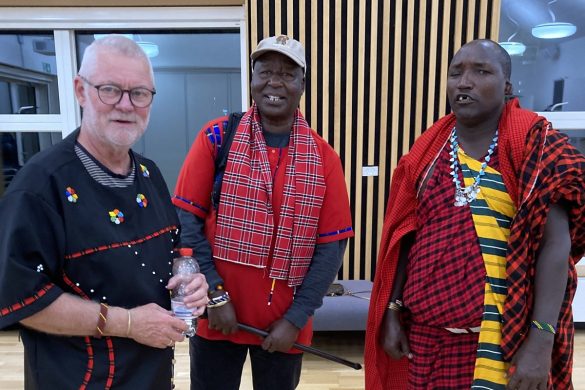

– Once the project is implemented, a resident of Mali will be able to travel easily by road to Niger, Benin and Burkina without impediments, explains Noel K. Tshiani, World Bank Task Team Leader and Project Manager.

– This is exciting because it will facilitate a free circulation of people and goods and can contribute significantly to economic growth and market integration. It will increase intra-regional trade and provide more opportunities for people, added he.

A major impediment to West African regional economic growth has been the lack of diversified financial products and services for individuals and businesses. This initiative is part of a broader regional strategy to create a stable economic environment for investors and increase foreign direct investment.

The population would benefit from the development of an efficient and liquid regional capital market supporting the countries financing needs with resources for businesses and individuals to finance investments.

Other gains include more employment opportunities and efficient services for the population and private commercial financing for local and region-wide infrastructure like the integrated road network.

The financial package was approved to the Banque Ouest-Africaine de Developpement (BOAD), the regional development bank that is owned by the member states, the Central Bank of the West African States (BCEAO), the African Development Bank, France, Belgium, Germany and the European Investment Bank.

BOAD will mobilize financing for investment, thus reinforcing its capacity and changing it from an institution dependent on donor resources to one that can fund private investments on its own.

Much like the partnership of nations comprising WAEMU, the five year project is financed by a partnership of governments and organizations, including Agence Francaise de Developpement and the Canadian International Development Agency (CIDA).

The World Bank Groups contribution to the project consists of an International Development Association (IDA) credit of 96.39 million dollar, an IDA insurance guarantee of 70 million dollar, and a Multilateral Investment Guarantee Agency (MIGA) insurance guarantee of 70 million dollar.

As added incentive, the IDA-MIGA-AFD Guarantee facility will provide guarantees insurance for longer-term private investments in small and medium-sized infrastructure and privatization projects by mitigating the political and commercial risks that constrain investors.

– The program selectively addresses three major sector-related issues, notably the weak capacity of key institutions active in the capital and financial market; the lack of long-term capital for public investment projects and the lack of financing for private infrastructure, says Noel K. Tshiani.

Kilde: www.worldbank.org