Artisanal mining has a terrible reputation. A widespread perception is that this low-tech and labor-intensive way to extract natural resources “may cause severe environmental and health risks, conflict and generally few economic benefits.”

Yet an estimated 40.5 million (+/- 25%) people around the world are directly working in these mines. What persuades them to do so?

Læs også: Ghanas guld koster liv (29.09.2017)

Using the exceptional quasi-natural experiment provided by the recent gold boom in Burkina Faso, my Job Market Paper, co-authored with Rémi Bazillier, documents the local impact of artisanal and small-scale mining (ASM).

We investigate the impact of the gold price boom on households’ wealth when households live around artisanal mines, and contrast this impact with the impact of opening industrial mines.

Pinning down the effect of artisanal mines

Our identification strategy exploits two sources of variation: changes in the gold price, and the geological setting of Burkina Faso.

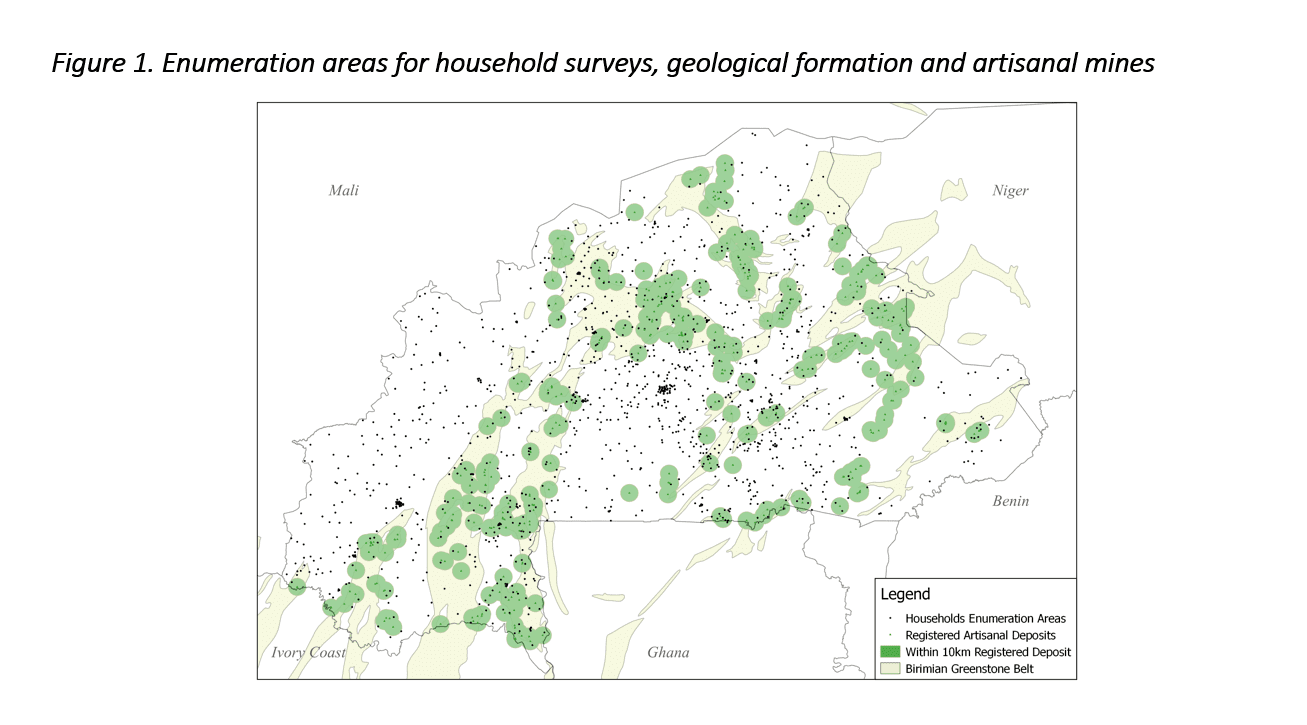

Spatially, we consider as treated the households who live close to an artisanal mine (either within the 10km buffer zone, or above the Bririmian greenstone belt shown in Figure 1, the main geological formation that accounts for the incidence of gold in Burkina Faso).

Temporally, the gold pricemultiplied by 4 between 1998 and 2014, directly increasing the benefits of artisanal gold mining. In our baseline specification, we interact a dummy equal to 1 for households living close to an artisanal mine with the log of the gold price.

Figure 1 shows the location of households and mines across the country. The Statistical institute of Burkina Faso gathered geo-coded data for 34,000 households at 4 different points in time (the years 1998, 2003, 2010 and 2014).

We measure household wealth through consumption and investigate whether households that live close to artisanal mines are richer than other households, during periods of high gold price.

Surprise? Artisanal mines may have positive wealth spillovers.

We document a strong positive impact of artisanal mining on wealth. Figure 2 gives an overview of the change in consumption patterns, following changes in the gold price, according to the distance of households from an artisanal mine.

Econometrically we estimate that the households located close to artisanal mines consumed 15% more during the gold boom (in the years 2009 and 2014) than households living farther away from artisanal mines.

We also document that the benefits of artisanal mines are predominantly harnessed by households which can either diversify their economic activities, or which benefit from increased local demand for goods and services (induced by gold diggers).

Moreover, in sharp contrast to the positive results we obtain on artisanal mines, industrial gold mines, 7 of which opened in Burkina Faso between 2007 and 2014, have no impact on local wealth.

We use a binary variable to indicate which households have an industrial mine opening in their proximity.

We show that the opening of these mines is orthogonal to local wealth, a result consistent with Hirshman’s notion of enclave activity.

While we admit that industrial mines may improve local wealth though an active investment in local content that increases local linkages, in the case of Burkina Faso, our findings suggest that the boom in industrial mining has not so far induced any such effect.

Main takeaways

Artisanal mines may be a blessing. A back-of-the-envelope calculation suggests that a high gold price translates into 8 additional cents (in euros) of consumption each day for each person living around an artisanal mine.

This additional consumption is economically significant, given that the average household member in our sample consumes 55 cents on an average per day.

As yet, the opening of industrial gold mines does not make households in their surrounding richer.

Food for thought?

The insurance properties of artisanal mines deserve further attention.

We detail in the paper that the functioning features of artisanal mines in Burkina Faso make them a good example of common property management, while industrial mines privatize the resource by enclosing their production area.

Thus, our results are consistent with the idea that open access to a resource may be used as an asset of last resort for poor populations and illustrate the possibility of a welfare advantage of common properties over privatization for local communities.

Finally, whether artisanal and industrial mines are complements or substitutes depends on the juridical characteristics of mining concessions.

Artisanal and industrial gold mines typically target neighboring but not completely overlapping areas. There is both room and need to improve cohabitation between the two.

Victoire Girard er økonomiforsker ved Université d’Orléans, Frankrig.