Tanzania is actively diversifying its energy mix and moving away from its decades-long dependence on hydro. Modern infrastructure, the development of considerable national gas reserves and ensuring secure and affordable energy for Tanzanians are critical for the country’s future growth.

Now a comprehensive national policy with widespread political support has been launched, aimed at attracting much-needed investment.

Prospects are good: according to the Tanzanian committee of the World Energy Council, Tanzania is open for business.

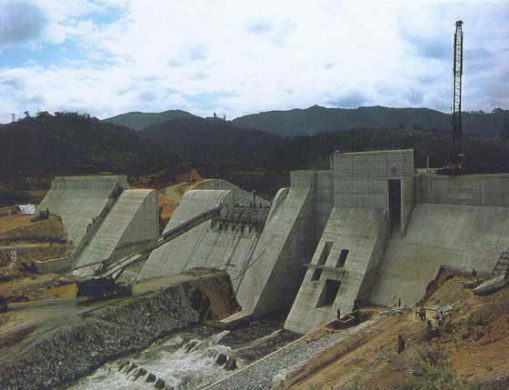

Traditionally Tanzania has been heavily dependent on hydropower, but in recent years recurring droughts have crippled the operations of the country’s major hydro facilities. The East African nation responded by tapping into its big reserves of natural gas to generate electricity, making up for the hydropower shortages with natural gas-fired turbines.

Tanzania has proven reserves of natural gas in excess of 50 trillion cubic feet – about ten times current total gas consumption in the whole of Africa.

This is more than enough to put the country on a faster economic development path and help it build energy independence, but at the cost of higher carbon emissions.

As of September 2015, the total installed electricity generation capacity is 1,246 MW; composed of hydro 562 MW (45 percent), natural gas 441 MW (or 35 percent) and liquid fuel 243 MW (or 20 percent).

The droughts that hit hydropower capacity not only led to rationing, but also to higher prices. In 2014, domestic and industrial energy consumers faced a 40 percent increase in electricity tariffs. Currently, only 24 per cent of Tanzanians are connected to the grid; in rural areas only 7 percent.

“Although we have seen some achievements recently, there are still many challenges to be faced”, says James Andilile, Assistant Commissioner for Energy development at Tanzania’s Ministry of Energy and Materials.

“We must increase access to modern sources of energy and support research and development of appropriate energy technologies, increase private sector participation, expand our infrastructure, and raise the finance to do this. Security of supply, and reducing the cost of supply are very important. Environmental protection is also a factor and at present there is inadequate awareness of the benefits and methods of energy conservation and efficiency.”

Political will

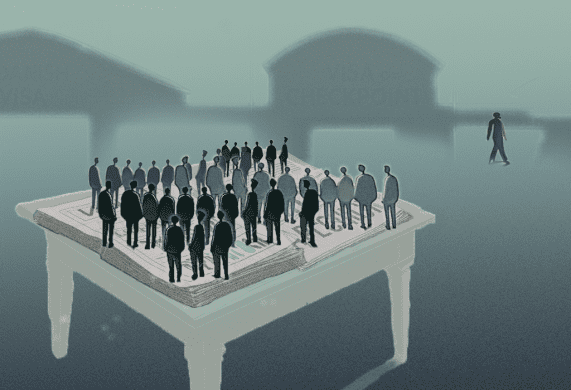

The National Energy Policy 2015 has been formulated to address these challenges. The policy was the result of an intense process in which a large number of dedicated people participated, including development partners (a group of 17 bilateral and five multilateral development agencies, including the UN).

The policy was approved by the cabinet in May 2015. “There’s no doubt that there’s a political will towards ensuring that the policy is fully implemented”, says Andilile.

The new policy is expected to increase access to modern energy services, promote security of supply, encourage energy efficiency and renewables, promote cost-reflective pricing mechanisms and reduce dependence on imported petroleum.

The National Energy Policy follows upon the Electricity Supply Industry (ESI) Reform Strategy and Roadmap announced last year.

Aims of this roadmap include: increasing investment from both private and public sectors, enhancing private sector participation, increasing connection and access levels to electricity, diversifying sources of energy for electricity generation and supply, and enhancing affordability and reliability of electricity supply.

A key challenge of implementation is the restructuring of state-owned TANESCO (Tanzania Electric Supply Company limited). Following the recommendations in a series of external consultants’ reports, the Roadmap proposes the staged unbundling of TANESCO, provision for TANESCO paying off its current debts, and the retirement of costly emergency power producers (EPPs).

Business Prospects

The private sector is participating in the energy sector under independent power project (IPP), or public-private partnership (PPP) arrangements.

It has been a mixed experience to date, with delays in delivering the projects and private companies demanding excessive guarantees from government to make projects risk- free. Nonetheless, overall experience has been positive and PPPs have been extended to the development of midstream and downstream infrastructure projects, as well as transmission and distribution networks.

Many African countries, such as South Africa and Nigeria, have started on power sector reforms to reduce the dependence on state-owned utilities and to encourage private sector investment and IPPs. According to Andilile, “Tanzania is actively building on other countries’ experiences to get the legislative, regulatory and policy framework right.”

Interconnections

Tanzania is also tackling its energy challenges by improving electricity interconnections with its neighbours. Currently, Tanzania imports electricity from Uganda (8 MW), Zambia (5 MW), and Kenya (1 MW).

The country takes part in a number of regional generation and transmission projects, predominantly through the Eastern Africa Power Pool (EAPP), which Tanzania joined in 2010. Members are Burundi, Democratic Republic of Congo, Egypt, Ethiopia, Kenya, Rwanda, Sudan, Libya and Uganda.

Tanzania’s flagship project through the EAPP is Rusumo Falls, an 80 MW hydropower project which is being jointly developed by Tanzania, Rwanda and Burundi. Also as part of the EAPP, feasibility studies are underway on four regional transmission projects:

- Kenya (Rongai/Kisumu) – Tanzania (Nyakato/Mwanza) 220kV interconnector

- Masaka (Uganda) – Mwanza (Tanzania) 220kV transmission line

- Burundi (Zege – Itaba/Jiji – Mulembwe) – Tanzania (Kigoma) 220kV transmission line

- Tanzania – Zambia 400kV transmission line

Artiklen stammer fra nyhedsbrevet World Energy Focus #16, oktober 2015. Nyhedsbrevet udgives af World Energy Council.